Bitcoin Marketcap

$1.26T

Gold Marketcap

$30.58T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.26T

Gold Marketcap

$30.58T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

2 Mar 2021 | | Price when published: $49,055 (ROI since: +36.15%)

Filed under: fundamentals

reports

Mr Timmer looks at macro considerations broadly, taking a historical approach to analyzing the effectiveness of various inflation hedge assets. The 12-page report looks at bitcoin's potential within this framework, starting with its fundamental properties, supply and demand drivers, and recent growth and validation as an asset class.

Topics covered include:

- About bitcoin: Prospects, prospectors, and portfolio managers

- Bitcoin Stock to Flow

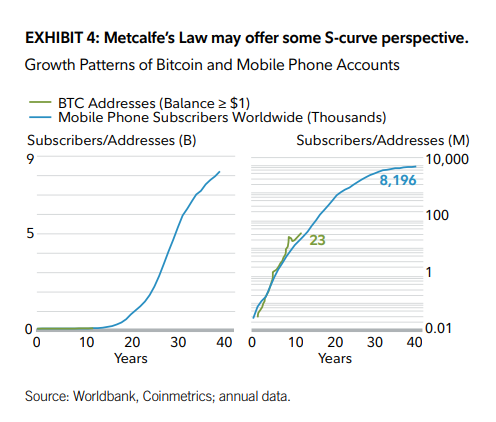

- Metcalfe's Law

- Gold and bitcoin as a store of value

- BTC Valuation

- Equities as an inflation hedge

- Asset classes over time

Among an increasing number of investors and portfolio managers, bitcoin is considered a legitimate and distinct asset class, and some may wish to consider bitcoin, alongside other alternatives, as one component of the bond side of a 60/40 portfolio.

...

In my view, bitcoin has gone mainstream, already considered a legitimate asset class by more and more investors. I think bitcoin has both a compelling supply dynamic (S2F) and demand dynamic (Metcalfe’s Law). At close to $900 billion, bitcoin is still just a fraction of gold’s total global value of roughly $11 trillion, not to mention total global financial assets of $160 trillion.

What do you think of this piece?