Bitcoin Marketcap

$1.38T

Gold Marketcap

$31.33T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.38T

Gold Marketcap

$31.33T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

22 Apr 2021 | | Price when published: $52,752 (ROI since: +37.97%)

Filed under: fundamentals

reports

This joint piece from Square Crypto and ARK Invest discusses the stabilizing effects that bitcoin mining can have on an energy grid, and how this incentivizes more rapid deployment of solar energy capacity, and other renewables.

In this memo, we aim to explain how the Bitcoin network functions as a unique energy buyer that could enable society to deploy substantially more solar and wind generation capacity.

...

We believe there are two large implications if bitcoin mining becomes normalized as an energy buyer of last resort. First, the amount of solar and wind energy on the grid could increase dramatically... The second major potential impact could be a sizable transformation and greening of the bitcoin mining industry.

...

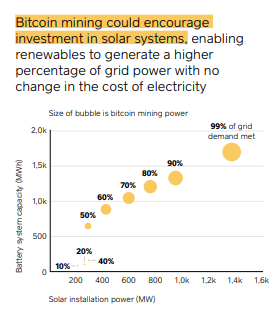

With real-world data, we (ARK Invest) demonstrate that bitcoin mining could encourage investment in solar systems (solar grids + batteries), enabling renewables to generate a higher percentage of grid power with potentially no change in the cost of electricity.

What do you think of this piece?