Bitcoin Marketcap

$1.30T

Gold Marketcap

$31.40T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.30T

Gold Marketcap

$31.40T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

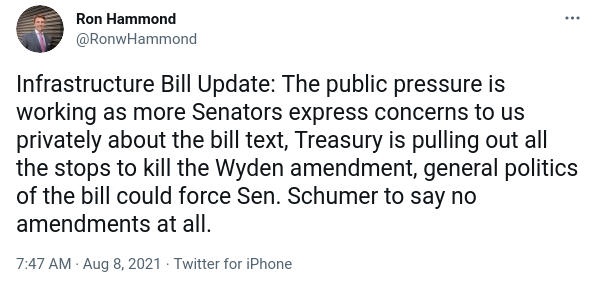

Ron Hammond, Director of Government Relations for the Blockchain Association, tweeted that the Treasury Department is "pulling out all the stops to kill the Wyden amendment". The amendment, introduced by Senators Wyden (D-OR), Lummis (R-WY), and Toomey (R-PA), fixes some of the stifling and impossible-to-comply-with language in President Biden's "must-pass" "infrastructure bill". The bill contains hastily-added language, in a misguided attempt to "pay for" a small portion of the bill's total cost by vastly expanding the definition of a cryptocurrency "broker". The new definition imposes excessive (& unworkable) surveillance requirements on many bitcoin and crypto companies and actors, including, potentially, entities such as miners and developers.

The bitcoin and crypto communtities have rallied behind the Wyden/Lummis/Toomey amendment, which explicitly exempts various entities from the new "broker" language, including miners and developers. Grassroots calls to senators nationwide have revealed meaningful influence in Washington, and contributed to the vote on the key bill being delayed several times.

An alternative amendment, offered by Senators Warner (D-VA) and Portman (R-OH) attempts to clarify the language as well but leaves large gaps in exempted entities, most notably developers. Mr Hammond and others have noted that the Treasury department is behind both the original last-minute language added to the Infrastructure bill, as well as the Warner/Portman amendment which does not sufficiently fix the language. The all-too-probable speculation is that Treasury wants to include vague and wide-reaching language in order to preserve optionality in aggressively attacking the industry through internal regulatory rule-making processes once they have legislative cover to do so. After all, bitcoin and crypto offer an alternative form of money and a new and open way to build a financial system.

Make Your Voice Heard

Anyone who cares about bitcoin and the ability to participate in the bitcoin economy in the United States should tweet (any time) or call (during business hours) their senators, encouraging them to support the Wyden/Lummis/Toomey amendment. Phone numbers and sample talking points can be found at the fightforthefuture.org.

Keep Track of Your Senators

A website keeping track of which senators have come out either for or against the bitcoin and crypto economy can be found here: didtheyvoteagainst.me.

tldr