Bitcoin Marketcap

$1.15T

Gold Marketcap

$14.06T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.15T

Gold Marketcap

$14.06T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

11 May 2020 | | Price when published: $8,655 (ROI since: +605%)

Filed under: fundamentals

reports

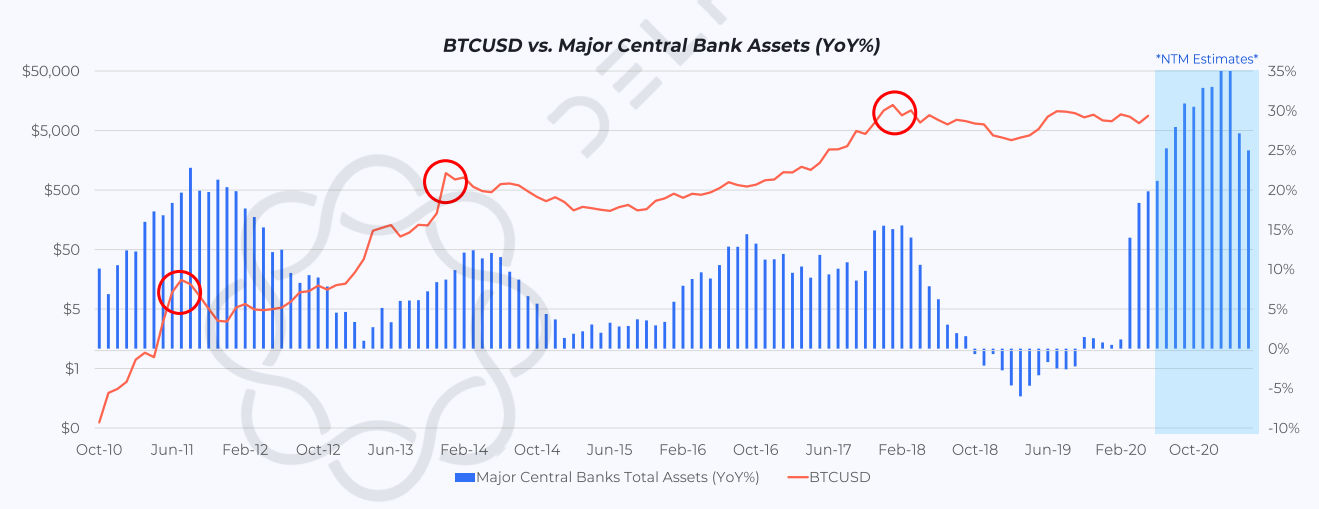

This extensive report dives into all aspects of the bitcoin ecosystem, building the case for bitcoin through a combination of fundamentals, macro, and data-driven analysis. This piece includes dozens of charts and tables that contextualize bitcoin for the reader across everything from macro and central bank liquidity, to on-chain fundamentals and large-trader positioning.

Major topics covered include:

- Why Bitcoin? Why Now?

- Adoption & Distribution

- Exchange Flows

- UTXO Analysis

- Upcoming Upgrades

- Lightning Network

- Mining Analysis

- Contributor Pieces

In our view, Bitcoin's value is backed by the demand for a non-sovereign, censorship resistant, digitally native asset with a perdetermined, hard-capped supply. Therefore, its current value is backed by the demand for an apolitical speculative asset that may or may not turn out to be one of the world's most valuable safe havens. Bitcoin, at its most primitive level, represents the ultimate check on monetary and fiscal authorities by providing a non-sovereign, censorship resistant alternative to today's monetary system.

What do you think of this piece?